0086 13635632360

0086 13635632360

On the morning of May 8, Anhui Shengxin New Materials Co., Ltd. held a production scheduling meeting in May 2020 to inform the production and operation of April, release the May output value plan and deploy the next stage of production and operation in detail. Chairman Xu Wuqing attended the meeting and delivered a speech, and General Manager Yuan Anzhi chaired the meeting. The company's deputy general manager at home and head of department (workshop) attended the meeting. The meeting emphasized that it is necessary to use iron hand to grasp the quality and iron hand to grasp the process. In the production and processing process, we must bring a good team, attach great importance to the standard operation of each process, completely eradicate the old faults, and improve the yield of the product; in the quality inspection process, we must strictly control the quality of each process and firmly eliminate unqualified products. Into the next process; at the daily morning meeting, we must analyze and study the problems existing in the work of the previous day, propose practical solutions to the problems, and prevent the same problems from recurring in actual work. The meeting required that the tacit understanding between the departments is related to the long-term development of the enterprise. Departments should strengthen the communication and exchange of information to form a joint force for jointly opening up new markets and developing new customers. The person in charge of the department should enhance the sense of responsibility to dare to assume responsibility, face the difficulties, overcome the fear of difficulties, and complete the production and operation tasks on time and quality. The meeting also put forward clear requirements on epidemic prevention and control, work safety and other work.

Read More

From January to March 2020, the production and operation of the non-ferrous metal industry were generally stable, but affected by the new crown epidemic, industry benefits and investment decreased year-on-year, and development confidence was insufficient. First, production is generally stable and prices have stabilized. From January to March, China's output of ten nonferrous metals was 14.17 million tons, an increase of 2.1% year-on-year, of which the output of copper, aluminum, lead, and zinc were 2.29 million tons, 8.84 million tons, 1.19 million tons, and 1.5 million tons, respectively, year-on-year growth 0.4%, 2.7%, -6.4%, 11%. The output of copper and aluminum materials was 3.67 million tons and 10.52 million tons, down 5.9% and 6.3% year-on-year. From January to March, the average spot prices of copper, aluminum, lead, and zinc were 45316 yuan / ton, 13438 yuan / ton, 14504 yuan / ton, and 17142 yuan / ton, down 7%, 0.9%, 16.6%, and 22.6% year-on-year. Since then, prices have stabilized, and the average spot prices of copper, aluminum, lead, and zinc rose by 9.5%, 5.6%, 2.1%, and 7.2% respectively from the end of March. Second, the efficiency has fallen sharply, and the industry's confidence is insufficient. From January to March, the non-ferrous industry realized a profit of 15.5 billion yuan, a year-on-year decrease of 31.5%. Among them, the mining and processing industries achieved profits of 5 billion yuan and 4.9 billion yuan, down 34.4% and 42.4% year-on-year, respectively, and the smelting industry realized profits of 5.6 billion yuan, an increase of 2.2% year-on-year. The Nonferrous Metals Prosperity Index for March, which was calculated by the Nonferrous Metals Association, was 16.6, which was in a relatively cold range. The industry enterprise confidence index in the first quarter was 44.8, which was 4 basis points lower than that in the fourth quarter of 2019 and the lowest point in three years. Thirdly, investment decreased year-on-year, and the decline in aluminum exports narrowed. From January to March, investment in the non-ferrous metal industry decreased by 11.4% year-on-year, of which investment in mining and processing fell by 10.8% year-on-year, and investment in smelting and processing decreased by 11.6% year-on-year. The export of aluminum materials was 1.12 million tons, a year-on-year decrease of 12.2%, which was 8 percentage points narrower than that in January-February. The export of unwrought copper and copper materials was 223,000 tons, an increase of 3.5% year-on-year. From January to March, the production of major aluminum products remained generally stable. The output of electrolytic aluminum was 8.84 million tons, a year-on-year increase of 2.7%, and the output of alumina and aluminum materials was 16.93 million tons and 10.52 million tons, a year-on-year decrease of 7.2% and 6.3%, a decrease of 1%. -February narrowed by 5.8 percentage points and 6.2 percentage points in February. The aluminum industry reali...

Read MoreAccording to data released by the US Geological Survey on Tuesday, in February, the import volume of US aluminum products and scrap aluminum plummeted 47% year-on-year to 238,000 tons. From January to February, the cumulative output of aluminum imported from the United States was 563,000 tons, down from 935,000 tons in the same period last year. Among them, 494,000 tons of crude metals and alloys accounted for most of the imports. In February, the United States imported 150,000 tons of aluminum from Canada, which was the main source of imports for the month, including 145,000 tons of crude metals and alloys and 5,300 tons of scrap aluminum. In February, Saudi Arabia was the main source of imports of US semi-finished aluminum products (aluminum sheets, sheets and bars), with an import volume of 7,450 tons. In February, US aluminum imports from China fell to 5,070 tons, and the cumulative imports from January to February were 13,000 tons, down 15,600 tons and 31,000 tons from the same period last year. In February, the amount of scrap aluminum imported from Mexico plummeted by 86%, and the amount of scrap aluminum imported from the United States also fell to 8,520 tons from 44,500 tons in the same period last year. In February, the United States imported 1,640 tons of scrap aluminum from Mexico, compared with 11,700 tons in the same period last year. In February, the United States exported 236,000 tons of aluminum products and scrap aluminum, down from 240,000 tons in the same period last year. The main aluminum exporting countries of the United States that month: Mexico (50,200 tons), Canada (46,500 tons) and India (33,000 tons). In February, the United States exported 138,000 tons of aluminum to China, down from 39,600 tons in the same period last year. The decrease in exports was mainly due to a 70% drop in scrap aluminum exports to 11,400 tons.

Read More

When the new crown pneumonia epidemic was raging in China, the production and supply of overseas car companies were once affected due to the shortage of domestic parts. Today, the epidemic of new crown pneumonia spreads all over the world, and it also casts a shadow over the two major automotive industry centers in Europe and North America. According to incomplete statistics, as of March 19, 12 overseas car companies including Daimler, Volkswagen, Fiat Chrysler Group (FCA), Peugeot Citroen Group (PSA), etc. have closed or plan to shut down. More than 100. At present, the European region is the most affected. More than 90 factories have been closed. Due to the epidemic, the number of registered passenger car markets in the European Union in February 2020 fell by 7.4% year-on-year to 957,052. Worst start since 2013. The shutdown and production will exacerbate this dilemma. At the same time, the impact of North America is gradually emerging, and the three major US giants are planning to shut down North American factories including the United States, Canada, and Mexico. According to CNBC reports, data from RBC Capital Markets show that the ripple effect of the new coronavirus pneumonia epidemic on consumer demand may lead to a 16% decline in global car production in 2020, while US car sales are expected to decline by 20%. A global epidemic is challenging the already depressed global automotive industry.

Read More

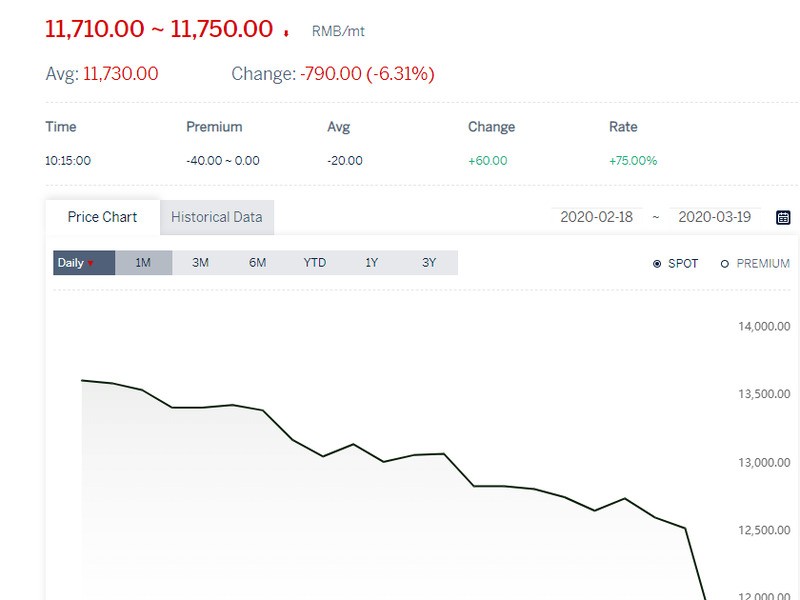

In the early morning of March 19, the comprehensive market analysis of cnal.com: the average price of non-ferrous aluminum in the Yangtze River fell 60 to 12,530 in the previous trading day, and the average price of non-ferrous aluminum in the South China Sea fell 90 to 12,780. Shanghai Aluminum Spot Monthly Contract opened at 12690 in 2003, with a maximum of 12690 and a minimum of 12155. It closed at 12240, down 445 or 3.51%. Lunco Aluminum 3 opened at 1650.00, highest at 1651.50, lowest at 1613.00, and closed at 1638.50, down 4.50 or 0.27%. The US dollar index opened at 99.59, the highest was 101.75, the lowest was 99.15, and closed at 100.89, up 1.31 or 1.31%. LME aluminum inventory decreased by 5,725 tons to 967,325 tons. The warehouse receipts in the previous period decreased by 2721 tons to 301,491 tons. 1. The European Central Bank announced on the early morning of March 19 that it will implement a temporary, 750 billion euro epidemic emergency purchase plan (PEPP). The purchase of the target includes private and public sector securities to address the serious risks faced by the monetary policy transmission mechanism. In terms of purchasing public sector securities, benchmarking cross-jurisdictional allocations will remain the capital key for central banks in the member states. The purchase plan will be implemented until the end of 2020. All asset classes will be eligible under the existing asset purchase plan (APP), and Greek debt will be included in the purchase scope according to the exemption policy. The scope of eligible assets will be expanded to non-bank commercial paper, and the scope of collateral will be expanded to include additional credit claims. Part of the "self-limitation" of quantitative easing (QE) may be detrimental to the actions that the ECB must take to fulfill its duties. The ECB's management committee will adjust its considerations to the necessary state, and will not tolerate any risks of smooth policy transmission. . Be prepared to expand the scale of asset purchases when necessary and adjust the composition of asset purchases. 2. WHO: The cumulative number of new crown cases worldwide has exceeded 190,000. According to the latest data released by Johns Hopkins University in the United States, a total of 10082 new crown cases were confirmed in Germany, 26 died, and 73 were cured. So far, Germany has become the world's fifth country with more than 10,000 diagnosed cases. The number of new crowns in the United Kingdom increased to 2,626, compared with 1950 in the previous day. The market's terror spread to non-ferrous metals, and the daily limit of copper for two consecutive days led to the general diving of metals. Aluminum prices are expected to fall sharply today for reference only.

Read More online service

online service 0086 13635632360

0086 13635632360 sales@sxalu.com

sales@sxalu.com 008617309695108

008617309695108